Introduction:

All vital information about bankruptcy and the downside of filing for bankruptcy are covered in this article.

After going through various researches, I came up with this high quality guide, which will guide you step by step.

The filing of a bankruptcy petition has both positive and negative implications. Discover which assets you may be forced to liquidate. And who will be notified of your bankruptcy, and how long it will take for your credit score to improve, if you file for bankruptcy protection.

Below are some factors of bankruptcy, regarding what is the downside of filing for bankruptcy.

What Is Bankruptcy?

Bankruptcy is the Inability of an individual or corporation to pay debts resulting in the filing of a bankruptcy petition.

The bankruptcy process begins with the filing of a petition, which may be on behalf of the debtor or creditors, depending on the circumstances.

How Bankruptcies Work

When you file for bankruptcy, your debts are either reorganized to make them more manageable to pay off or completely discharged. Which simply means you will not be responsible for any of them going forward.

What happens next varies depending on which chapter of bankruptcy you choose to file under.

What Is The Downside Of Filing For Bankruptcy?

People and businesses who have a lot of debt may be able to get out of debt by filing for bankruptcy. Declaring bankruptcy, on the other hand, may make it more difficult to get a mortgage or car loan for a while.

It has a negative reputation that isn’t always accurate. This includes things like:

1. The Implications For Your Credit Score;

- The Bankruptcy Will Appear On Your Credit Report For A Period Of Up To Ten Years After You Have Filed For Bankruptcy Protection

You could have your bankruptcy on your credit report for up to ten years if you apply for a loan of $180,000 or more after filing bankruptcy.

- Not Being Able To Obtain A Car Loan Or A Home Mortgage

A bankruptcy will prevent you from applying for a car loan or a mortgage if your credit report shows that you have filed for bankruptcy in the past. If you are approved, you will almost certainly have to pay higher loan fees and interest rates.

- The Majority Of Your Debts Will Be Impossible To Pay Off In A Short Period Of Time

You will not be able to discharge all of your debts if you file for bankruptcy after declaring bankruptcy.

Among the debts that will not be discharged by the bankruptcy court are student loan debt, child support, alimony, and other obligations.

Consider the fact that declaring bankruptcy may, in the long run, allow you to improve your credit score more quickly. Bankruptcy may be able to assist you in meeting your financial obligations on time.

2. Having To Wait To Get Out Of Bankruptcy For A Second Time

If you’re thinking about filing for bankruptcy, the right time is very important. For at least eight years after you file a Chapter 7 bankruptcy petition with the court. You will not be able to file another Chapter 7 bankruptcy petition. Also, If you file for Chapter 13 bankruptcy, you won’t be able to do anything for four years whenever you do so.

If you think you’ll have more financial problems in the future, like when you lose your job, you should think about delaying filing for bankruptcy. If you file for bankruptcy and then can’t find work, you won’t be able to file for a second bankruptcy until the required amount of time has passed since you first filed.

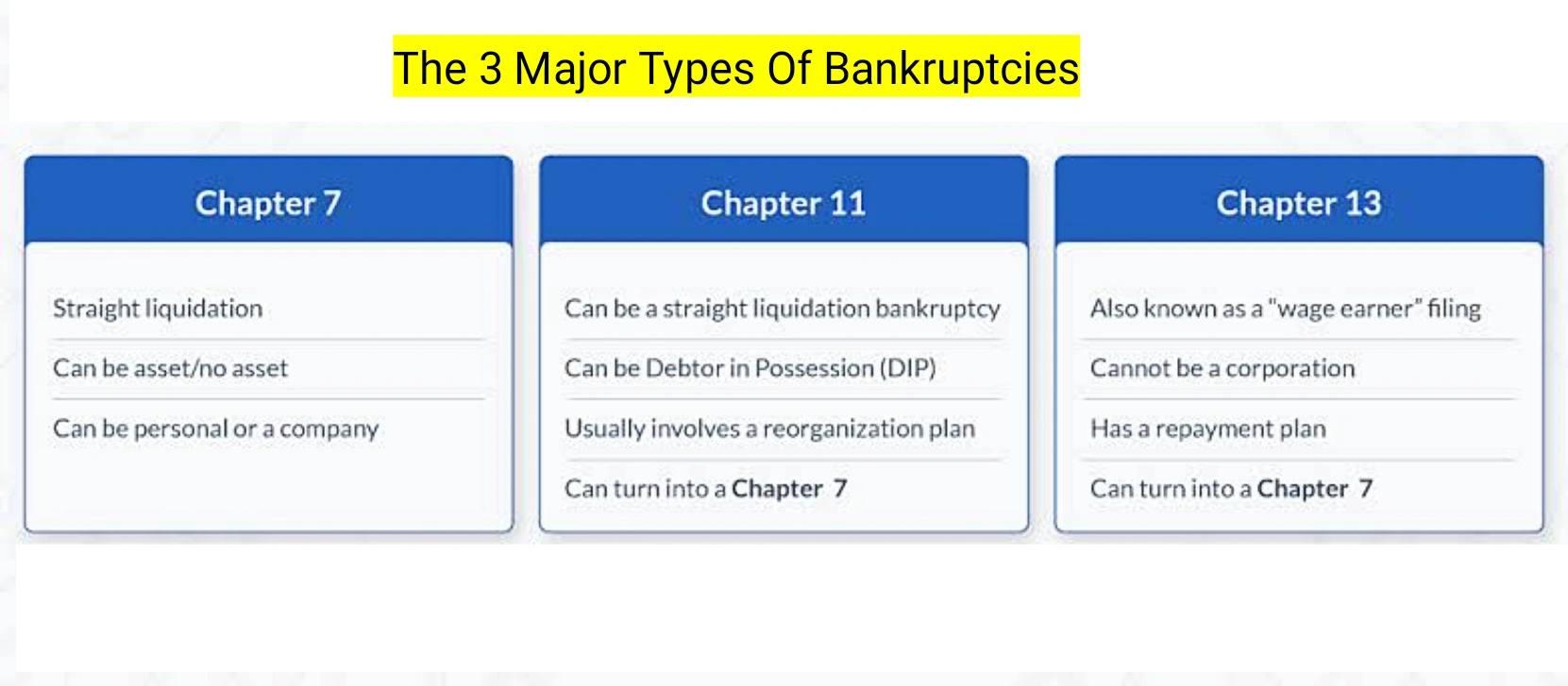

What Are The 3 Major Types Of Bankruptcies?

-

Chapter 13 Bankruptcy

Individuals with a regular source of income can file for Chapter 13 bankruptcy in order to devise a plan to repay all or a portion of their outstanding debts.

In this chapter, the debtors propose a repayment plan to creditors, with payments to creditors being spread out over a three- to five-year period.

Bankruptcy Code Chapter 7 also gives people who have steady jobs the chance to change their debts.

It’s better to file a small business for Chapter 13 bankruptcy than Chapter 11 bankruptcy. The business can then restructure instead of going out of business. If the bankruptcy court agrees with your debt repayment plan, it will help you get rid of your debts.

-

Chapter 7 Bankruptcy

Specifically, this chapter of the Bankruptcy Code addresses the sale of a debtor’s nonexempt property and the distribution of the proceeds to the debtor’s creditors.

Chapter 7 is also referred to as a liquidation in some circles. Debtors should be aware that there are several alternatives to chapter 7 bankruptcy that they should consider.

Debtors who are involved in the business world, such as corporations and partnerships, are a good illustration. As well as this, sole proprietorships may prefer to remain in business rather than going out of business altogether. A petition under Chapter 11 of the Bankruptcy Code should be considered by debtors who find themselves in this situation.

An adjustment of debts under Chapter 11 can be sought by reducing the debt. Or extending the time period for paying the debt back to the creditors.

Another option is to seek a more comprehensive reorganization. Chapter 13 of the Bankruptcy Code may also apply to sole proprietorships, depending on the circumstances.

-

Chapter 11 Bankruptcy

In bankruptcy, this section of the Bankruptcy Code is used to make sure that the debts of a business or a partnership are paid off.

This is what happens when someone files for Chapter 11 bankruptcy. They usually come up with some kind of reorganization plan to keep their business going while paying back their creditors over time. Whether you are an individual or a business, you can get help from creditors under Chapter 11.

File a Chapter 11 bankruptcy petition in order to get rid of all your debts and assets. Individuals, sole proprietorships, partnerships, and corporations can all use the service, as long as they follow the rules.

The reorganization allows the company to keep working even though the government is keeping a close eye on it. To get a loan, the debtor must do some of the things he or she has to do.

Since it is the most costly of all, it is the last thing you can do. Companies should think very carefully about all other bankruptcy options before deciding to file for Chapter 11 bankruptcy protection.

How To File Chapter 7 Bankruptcy?

It is possible to file for Chapter 7 bankruptcy on your own, but it is recommended that you consult an attorney first. There’s a lot on the line here, and the process can take a long time to complete.

The following is the sequence in which the procedure will take place:

-

Make Sure You Fill Out Forms

You can visit the website of the United States Courts, where you can download the documents.

-

Take Into Consideration By Taking A Credit Counseling Course

Individual and group credit counseling courses are available through credit counseling agencies. You’ll need them in order to file your paperwork.

-

You Are Needed To Pass A “Means Test

This will determine whether or not you are eligible to file for Chapter 7 bankruptcy protection. If your income is less than the state’s median income, you may be eligible.

Another scenario in which you might qualify is if your expenses are so high and your income is so low that you will never be able to pay off your debts completely.

-

Organize The Forms In The Following Chronological Order

It is possible to file the necessary forms right away, and then submit the remaining work within 14 days if you are short on time or haven’t completed all of the forms.

The cost of filing varies from state to state, but it is usually around $350 on average. You may be eligible for a waiver depending on your income statistics.

-

Ensure Your Documents Are Sent To A Trustee

Please note that, the information you provide on your forms is checked by the court-appointed trustee to ensure accuracy. Among the documents are tax returns, bank statements, paychecks, and business documents, to name a few.

-

Participate In A Creditors’ Meeting

A trustee and creditors meet together to discuss the trustee’s duties and responsibilities. Creditors are not required to attend and only do so infrequently.

While you are under oath, the trustee will interrogate you about your financial circumstances. The meeting is usually short.

-

Take Part In A Debtor Education Class Is Necessary

The completion of this second “financial literacy” course is required within 60 days of your creditor’s appearance. Otherwise, if you do not submit your certification of completion to the court, the judge may dismiss your case without further notice.

-

Ensure To Obtain Your Discharge

It is ordered by the court that all of your qualifying outstanding debt be discharged. The effect of this is that creditors will no longer be able to attempt to collect from you in the future.

Filing Bankruptcy, Chapter 13

In order to prove your eligibility for a debt reorganization to a bankruptcy trustee, you and your attorney will collaborate to prepare a plan that will be presented to the trustee.

The court will approve a plan to repay both unsecured and secured debts in part or in full, whether the plan is partial or complete. You’ll make payments over a period of three to five years while keeping your assets. The process may result in some debts being forgiven in full at the conclusion of the procedure.

Here are steps needed when filing bankruptcy, chapter 13:

-

Credit Counseling Services

Credit counseling with a nonprofit organization prior to filing for bankruptcy should be completed before filing for bankruptcy. In addition, your counselor may be able to assist you in developing a repayment strategy.

-

Consult With An Attorney

Hiring a qualified bankruptcy attorney is a wise decision. There are many steps to the Chapter 13 bankruptcy process, and skipping a step or incorrectly filling out a form can result in your case being dismissed or certain debts not being covered.

-

Completing Administrative Paperwork

Your attorney will guide you through the process of completing the various forms required for filing. You’ll need to gather information about your entire financial picture. Including your debts, income, real estate, and monthly expenses, before you can begin.

-

Fill Out And Submit A Bankruptcy Petition

The bankruptcy process begins with the submission of the various forms, also known as “filing” the bankruptcy. In this case, a bankruptcy trustee will be appointed.

As soon as you file, you are subject to what is known as an “automatic stay,” which means that most attempts to collect on your debts must be stopped immediately.

-

Making A Payment Plan Submission

Within 14 days of filing the petition, you must submit a proposed payment plan to the court. Even if your petition hasn’t been approved yet, you must begin making payments on the plan within 30 days of filing it in order to avoid being penalized.

-

Meeting Of Creditor’s Representatives

Following the filing of the petition for creditors, the trustee will convene a meeting between 21 and 50 days later. To discuss any issues that have arisen between you and the creditors.

-

Course On Debtor Education

Before filing for Chapter 13 bankruptcy, you must complete a “debtor education course” offered by a non-profit credit counseling organization.

-

Confirmation Hearings Are Scheduled

For the payment plan to be confirmed in court, you must appear in court no later than 45 days after the meeting of creditors. Also with the trustee and any creditors who wish to appear at the meeting of creditors.

-

Payment

Creditors are paid in accordance with the terms of the plan over a period of three to five years.

Another Reading Suggestion

What Are The Alternatives To Filing Bankruptcy?

-

Consumer Proposal

A consumer proposal is a written agreement between you and your creditors that outlines how you will pay off your unsecured debts in the shortest amount of time possible.

In exchange for making fixed monthly payments that you can afford based on your income and assets, you can submit a consumer proposal. Consult with a Licensed Insolvency Trustee for more information on the process.

-

Debt Consolidation

Debt consolidation is a type of debt refinancing in which you take out one loan to pay off a lot of loans at once. This is a term used to describe a personal finance process in which people deal with high consumer debt.

Your credit score may indicate that you are a good candidate for a debt consolidation loan if you have excellent credit.

If you’re having trouble keeping track of multiple debts with varying interest rates. You might want to think about taking out a loan to help you out. Keep in mind that you may be required to have a co-signer in order to secure a loan.

-

Informal Debt Settlement

Informal debt settlement is a voluntary agreement negotiated between you and your creditors on the terms of the debt you owe. It is a type of debt relief that is not legally binding.

You’ll need to contact each of your creditors individually in order to try to come to an agreement on interest rates, payment amounts, and payment schedules, all of which will require negotiation.

What Debts Are Not Discharged In Bankruptcy?

Debts that are not dischargeable in bankruptcy are those that are not permitted to be discharged under the Bankruptcy Code of the United States of America.

Some non-dischargeable debts are given this special treatment because the nature of the debt makes it in the public interest to prevent files from being able to eliminate it completely. For example, child support is a type of alimony.

Here are some debts that are not discharged in bankruptcy:

-

Debts For Alimony And Child Support Are Not Discharged When Filing For Bankruptcy

Domestic support payments that are past due will not be discharged in bankruptcy under any circumstances. When it comes to domestic support obligations, such as alimony and child support, bankruptcy does not provide a discharge.

A bankruptcy filing will not prevent your wages from being garnished to satisfy current or past due child support obligations. To catch up on child support or alimony payments that you have fallen behind on, you can file for Chapter 13 bankruptcy.

-

Student Loans Debts Are Not Discharged In Bankruptcy

Students’ loan debt is not dischargeable in bankruptcy, as the vast majority of people are aware of this fact. Such a discharge is only possible if certain conditions are met, which are extremely difficult to achieve.

You must demonstrate that repaying your student loans will put you in a difficult financial situation. If you can demonstrate that you met the first two requirements, you must also demonstrate that you made a good faith effort to repay the non-dischargeable debts.

-

Most Income Taxes Debts Are Not Discharged In Bankruptcy

Recent income tax debts will not be discharged as a result of a bankruptcy filing. Using a Chapter 13 repayment plan. You can pay off your non-dischargeable income tax debts in the same way that you can pay off your child support responsibilities.

Back taxes, like student loans, are exempt from collection during a Chapter 7 bankruptcy filing. If you owe a significant amount of money in taxes, you should consult with an attorney about obtaining professional assistance.

In order to determine which type of bankruptcy is most appropriate for your circumstances, you should consult with a bankruptcy attorney.

-

Secured Debts Are Not Discharged In Bankruptcy

If you stop making car payments while filing for bankruptcy, your car will be repossessed.

Secured debts are those that are linked to a specific piece of property, such as a car loan or, in the case of a mortgage, a house. So, just because you filed a Chapter 7 bankruptcy doesn’t mean you can stop making payments and keep the car.

How Much Does It Cost To File Bankruptcy?

However, between filing fees and the cost of hiring a good bankruptcy attorney, you could end up paying hundreds, if not thousands, of dollars.

Here’s how much you will pay for filing Chapter 13 and Chapter 7 bankruptcy:

| Chapter 13 | Chapter 7 | |

|---|---|---|

| Filing fees | $313.00 | $338.00 |

| Attorney fees* | $1,500 - $6,000 | $500 - $3,500 |

| Total Costs = | $1,813 - $6,313 | $838 - $3,838 |

What Does Bankruptcy Do To Your Credit?

While bankruptcy may alleviate some of your debt obligations, it will have a long-lasting effect on your credit.

Here are some ways bankruptcies impact your credit

-

Bankruptcy Appears On Your Credit Reports

Bankruptcy is a public record that may appear on your credit reports if you file for bankruptcy protection.

It is possible that it will have a negative impact on your credit for as long as it is on the list. A bankruptcy’s impact on credit can vary depending on the various factors that contribute to each individual’s credit score.

According to source, filed Chapter 7 bankruptcy petitions can appear on your credit reports for up to 10 years after the date of the petition.

Bankruptcy discharges obtained through Chapter 13 bankruptcy typically remain on your credit reports for seven years from the date of filing, but they may remain on your credit reports for up to ten years if certain requirements are not met.

-

Accounts Appear On Your Credit Reports

Customers who have had their accounts discharged in bankruptcy can have their accounts reported with a zero balance under the heading “Discharged” or “Included in bankruptcy.”

Although you may not owe anything on them, they will appear on your credit reports regardless. It is possible that lenders will notice this note on your credit reports and reject your credit application if you apply for credit. According to experts, as a result of the positive effects, your credit scores will eventually begin to improve.

Who Pays For Bankruptcies?

A typical scenario is that the person who files for bankruptcy is also the one who pays the court filing fee. Which goes toward funding the bankruptcy court system as well as other aspects of the bankruptcy proceedings.

Final Thoughts

Most debts can be forgiven, but bankrupt people will have a difficult time dealing with financial institutions or obtaining any type of credit.

It’s important to think about the benefits and drawbacks of filing for personal bankruptcy before making a decision.

Please leave a comment below and also share this article, if you found this post helpful.